Copayments, coinsurance and deductibles

Q: Why is it so important to collect the copayment at the time of service?

A: For the most part, the OIG Special Fraud Alerts have been reserved for national trends in health care fraud and have addressed potential violations of the Medicare and State healthcare programs’ anti-kickback statute. The Special Fraud Alerts have addressed the following topic areas that could violate the anti-kickback statute:

- Joint venture arrangements;

- Routine waiver of Medicare Part B copayments and deductibles;

- Hospital incentives to referring physicians;

- Prescription drug marketing practices;

- Arrangements for the provision of clinical laboratory

services.

Routine waiver of deductibles and copayments by charge-based providers, practitioners or suppliers is unlawful because it results in:

- false claims,

- violations of the anti-kickback statute, and

- excessive utilization of items and services paid for by Medicare.

There are potential legal ramifications for those who waive copayments, coinsurance and deductibles on a regular basis. Commercial insurance providers have contracts (i.e., legally binding agreements) to provide health insurance to employers and employees—and now, under the Affordable Care Act, to individuals as well. The health insurance contract establishes mutually agreed-upon deductible and copayment amounts for both in-network and out-of-network providers. Because this is a contract—which, again, is a legally binding agreement with an employer or individual—if a provider comes along and decides to unilaterally waive patient deductibles and copays, then the provider is reducing the covered person’s contractual financial obligation. By waiving deductibles and copays, the provider is interfering with the employer’s and/or individual’s contract with the insurance carrier—and that puts the provider at risk of being sued for damages.

Establish a procedure patients must use to demonstrate a financial hardship, and document it. Also, make sure the patient signs an acknowledgment that he or she has a financial hardship. Even if a patient can demonstrate a financial hardship, you don’t necessarily have to waive it in full. In other words, you’re free to negotiate. Ask the patient, “What can you afford to pay each visit?”

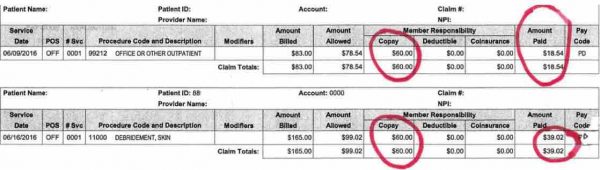

Copayments and Payer Payments

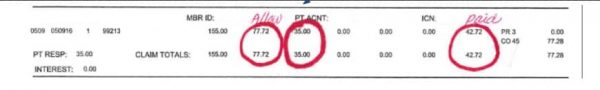

Note the paid amount by the payer versus the copayment due by the patient.

From a business management perspective. Look at the two payments below. What can you determine from the examples of payer payment versus copayment due?

What is Capitation?

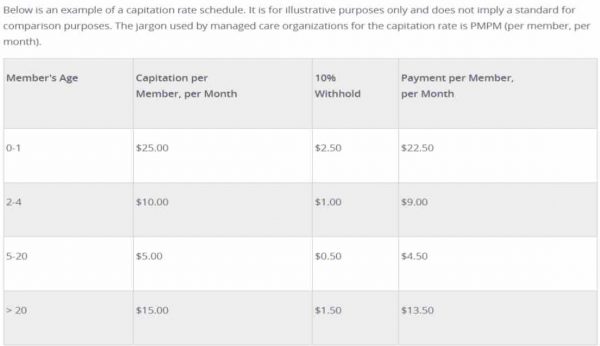

Capitation payments are used by managed care organizations to control health care costs. Capitation payments control use of health care resources by putting the physician at financial risk for services provided to patients. Capitation is a fixed amount of money per patient per unit of time paid in advance to the physician for the delivery of health care services.

Capitation is a fixed amount of money per patient per unit of time paid in advance to the physician for the delivery of health care services. The actual amount of money paid is determined by the range of services that are provided, the number of patients involved, and the period of time during which the services are provided.

Capitation rates are developed using local costs and average utilization of services and therefore can vary from one region of the country to another.

So what is a capitated payer system?

Capitation refers to a form of a healthcare payment system.

In a capitation model, a healthcare provider or individual hospital is paid by the insurer (or other payer) a fixed amount per patient during a given period of time.

If a provider sees 30 patients in 2015 each month with an insurance carrier and the average reimbursement per visit is $80.00, the provider will earn $2400.00 per month from the payer the following year (2016). Instead of receiving payment “per patient” he or she receives one check for $2400.00.

After one calendar year, the payer will assess how many patients were actually seen and adjust the capitated amount for the following year. If the provider only billed out $2000 instead of $2400, he can keep the extra money ($400) each month. If the provider sees 40 patients during the month at $80 per patient he should receive $3200 but he will not. He will still only receive the $2400

The amount of patients the provider sees will determine how much he or she will receive in capitated payments the following year.

The capitated amount for the following year can be more or less than what the provider received the current year based on productivity.

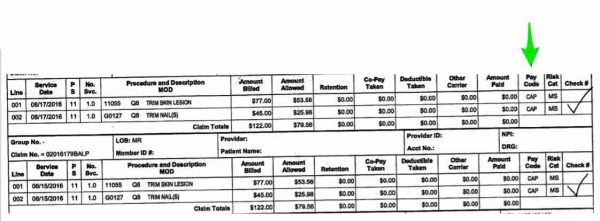

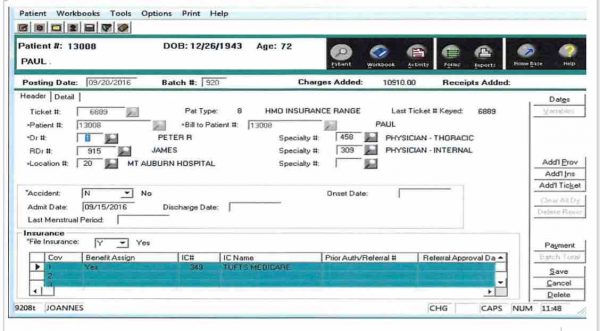

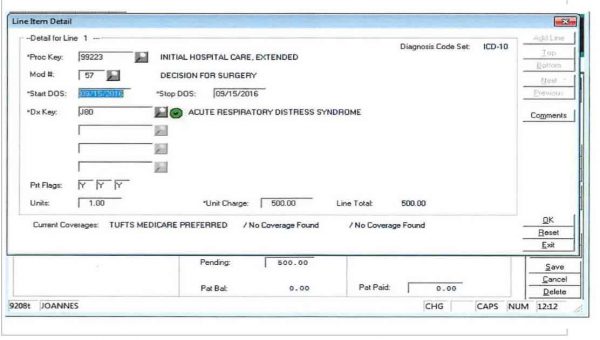

- What do you see under the payment column?

- What do you see as the Pay Code?

- What is the billed amount?

- What is the allowed amount?

- Why are the payments zero?

- This information is being gathered and assessed for the upcoming year. This calendar year is 2016. The doctor receives a monthly check for $2,286.80.

- Based on this information for 2016 and the fact that the doctor now sees 40 patients per month on this plan, the doctor will have his contract re-evaluated and will receive approximately $3,182.40 beginning in January 2017. ($79.56 x 40 patients)

- If a claim was denied on this RA, it would indicate the claim was denied under the Pay Code.

Know When to Collect Payments

Q: Patients have been calling and complaining about paying copayments for services that do not require copayments. They are reporting this to their insurance carrier who is contacting the billing office. How does the medical / billing office handle this?

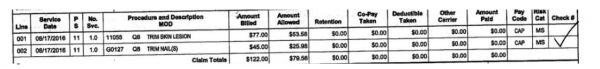

- The allowed amount was $79.56

- No copayment was charged

- The front desk collected a $25 copayment

- Patient has a $25 credit

How can this be resolved? It is a continuous problem.

- Pay back the patient unless she has another visit pending a copayment.

- Office visits are charged a copayment but not minor surgeries. Front desk should review the encounter form upon check out to see if a visit or just procedures were performed.

- This practice collects a copayment before the patient is seen based on the insurance card information but the copayment on the card is for office visits only. Eligibility is not verified.

- Office visit has a $35 copayment below

Charge Entry Process & Electronic Claims Process

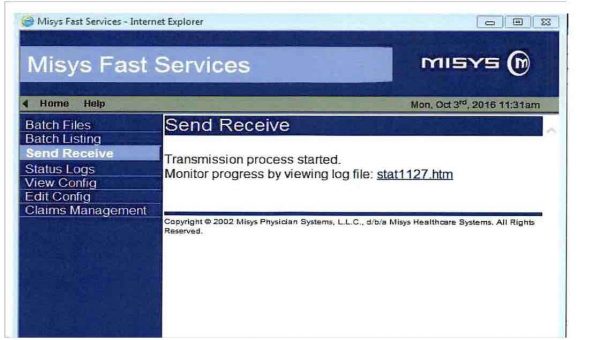

Q: How to follow a charge entry process and claims transmission?

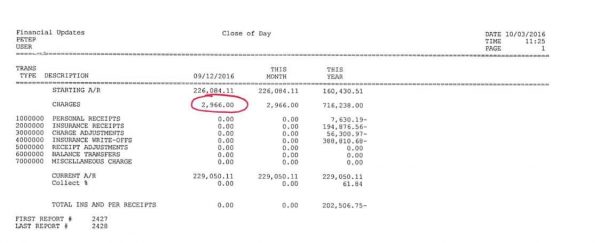

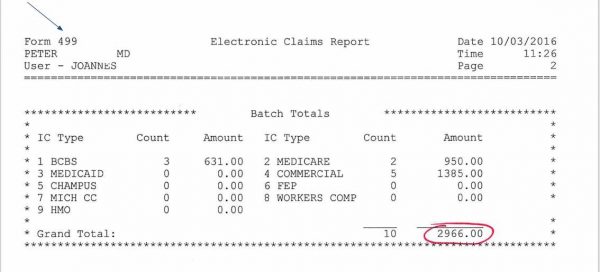

- Notice the Current Date on this Close of Day.

- It indicates $2,966.00 was entered in as charges.

- You can see a current month and a year to date.

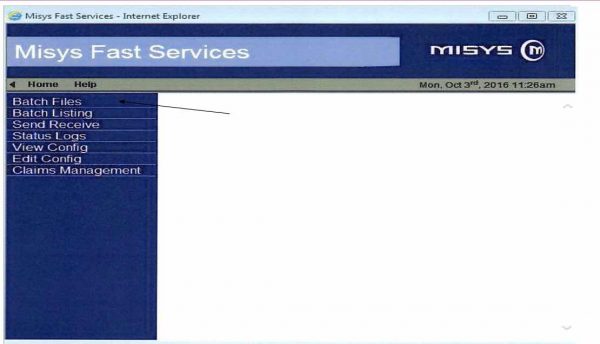

- This is an Electronic Claims Report. Notice the $2,966.00 states 10 claims totaling $2,966.00 are being transmitted. If there were any paper claims, they would not be listed on this report.

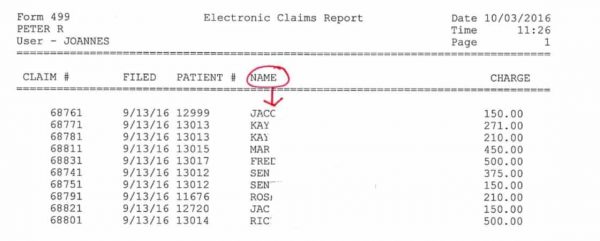

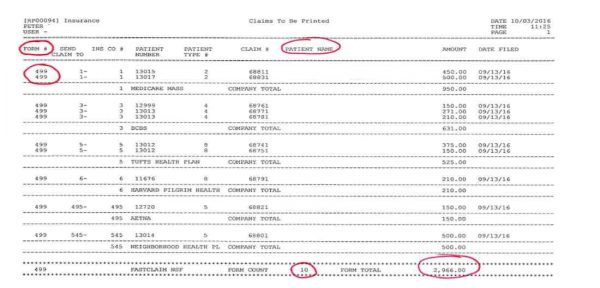

- Note that Form 499 represents the electronic claim form.

- Breakdown of patient claims being sent electronically.

- Claim # is the unique number assigned to the patient’s claim.

- This claim # will appear on the Remittance Advice.

- You will post from the RA using this claim #.

- Claim Form 499 = Electronic Claim Claim Form 3 = Medicare Claim Claim Form 1 = Others

- This report presents all electronic claims. If there were any forms 1 or 3 on this list, they would print to paper.

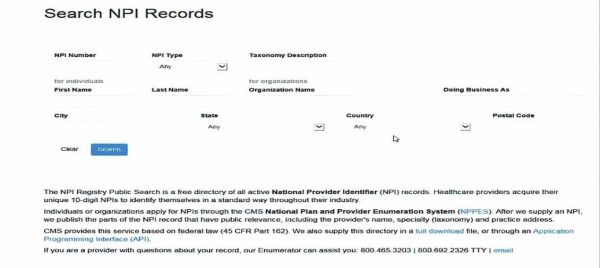

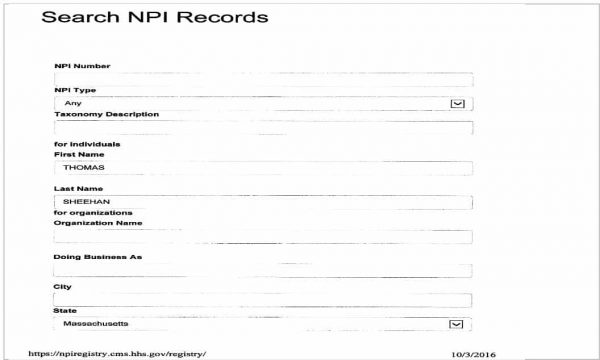

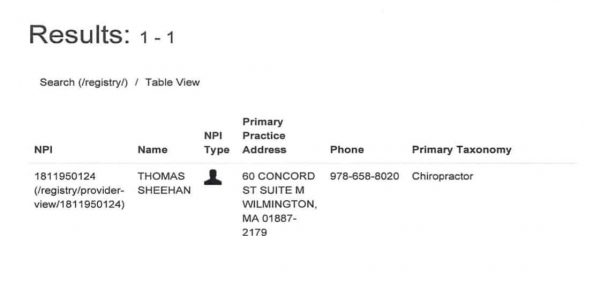

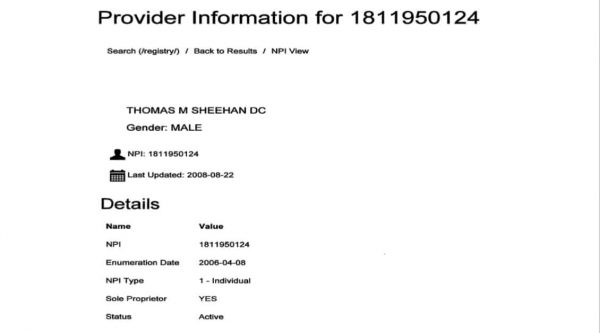

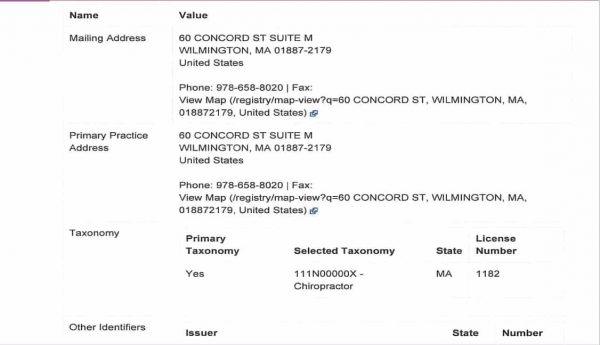

How to Access an NPI Number

- Go to NPI Search

- Information on Dr. Thomas Sheehan (used with permission from Dr. Sheehan)

![[CCO] Certification Coaching Organization LLC [CCO] Certification Coaching Organization LLC](https://www.cco.us/wp-content/uploads/2015/05/CCO-Logo-2015-d3-500px.png)